Emry Resources

Emry Health Helps Insured Patient Erase $4,700 in Cancer Bills

At just 24, two-time cancer survivor Ashley M. was facing $4,700 in medical bills despite having insurance. With Emry Health’s BillAssist platform, she was able to eliminate the entire balance and focus on her future—cancer-free.

Transform your health plan into a partner members trust

Get the Guide High medical costs and billing errors are more than personal challenges—they’re critical barriers to member satisfaction, retention and quality ratings. As healthcare costs rise, members need more than

From Cancer Survivor to Fashion Designer—Without the Burden of Medical Debt

By Kathryn Suddendorf, Emry Health client I was diagnosed with Stage 4S Neuroblastoma when I was just three weeks old. My parents had struggled to have children, and after years of

Emry Health Helps Cancer Survivor Eliminate $8,900 Medical Bill

An $8,900 hospital bill threatened Kathryn Suddendorf’s financial stability due to an insurance denial. Emry Health stepped in, uncovered billing errors, and worked with both the insurer and hospital to resolve the issue—ultimately reducing her bill to $0.

Emry Reduces $11,600 Hospital Bill to $3,725—Saving Member $7,912

When a member received a $11,600 ER bill with no financial assistance options and limited insurance coverage, they turned to Emry for help.

Emry Secures $0 Bill for Member Facing $43,868 Hospital Charge

Emry Health successfully intervened to reduce a member’s $43,868 hospital bill to $0 through their hospital financial assistance program

Reducing a $70,000 Surgery Bill to $0 Responsibility for Plan & Member

Helping health share plans and their members navigate high-cost medical bills through expert negotiation and financial assistance.

Healthcare Navigation: Maximizing the Value of Employee Benefits With Emry Health

A 90-life employer group demonstrated the clear benefits of using Emry.

Fighting the financial burden of cancer, together

Cancer for College has long been dedicated to empowering cancer survivors with need-based college scholarships and educational support. Now, with Emry BillAssist by their side, they’re taking this mission further—eliminating the

Breaking Down the True Costs of Health Insurance: What Premiums, Deductibles, and Copayments Mean for You

Navigating health insurance is notoriously confusing—and the numbers prove it. A recent study revealed that only 9% of insured individuals can accurately define basic terms like premiums, deductibles, and coinsurance. This

The Ultimate Guide to Lowering Out-of-Pocket Medical Costs

Get the Guide High medical costs and billing errors are more than personal challenges—they’re critical barriers to member satisfaction, retention and quality ratings. As healthcare costs rise, members need more than

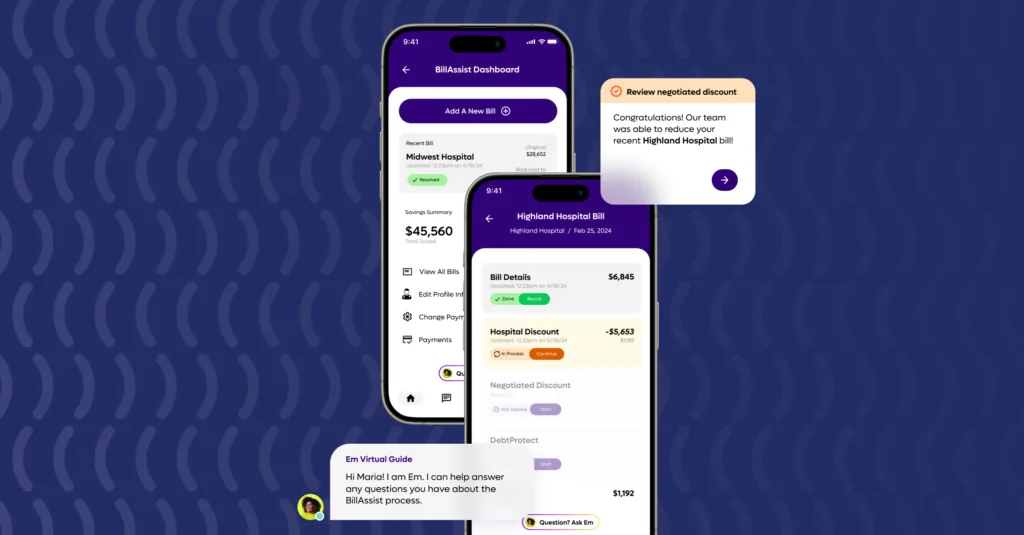

Emry Health Partners with Empara to Launch AI-Enabled Tech to Support BillAssist Service for Lowering Employees’ Healthcare Costs

Emry Health’s commitment to create better, lower-cost benefit experiences for members is now bolstered by BillAssist, an AI enabled tech and service solution for employer groups that lowers out-of-pocket healthcare costs

Are “Harmless” Over-the-Counter Drugs Driving Up Pharmacy Costs for Payers?

Over-the-counter (OTC) medications often seem harmless, given their easy accessibility and perceived safety. However, these drugs may unknowingly complicate medical conditions and interact with prescribed medications given to you by your

Clinical Pharmacists in Benefit Navigation: A Path to Cost and Time Savings

Navigating the maze of prescription drug access is fraught with obstacles—from understanding insurance rules to coordinating multiple medications and dealing with various prescribers. For many patients, even acquiring a single prescribed medication can be a daunting challenge, compounded by high costs and strict insurance regulations.

Goodroot Merges Medical Cost Advocate into Benefit Navigation Company Emry Health

Navigating the maze of prescription drug access is fraught with obstacles—from understanding insurance rules to coordinating multiple medications and dealing with various prescribers. For many patients, even acquiring a single prescribed medication can be a daunting challenge, compounded by high costs and strict insurance regulations.

Emry Negotiates $31.8K in Member Savings

Discover how Emry billing experts were able to negotiate a total savings of $31,800 in hospital bills.

From $195K to $25K: How Emry Delivered $170K in Member Savings

Discover how Emry helped a member apply for hospital financial assistance and successfully secured an 80% reduction, reducing the member’s liability to $25,000.

The Critical Role of Medication Guidance in Benefit Navigation

Navigating the maze of prescription drug access is fraught with obstacles—from understanding insurance rules to coordinating multiple medications and dealing with various prescribers. For many patients, even acquiring a single prescribed medication can be a daunting challenge, compounded by high costs and strict insurance regulations.

Integrating Hospital Financial Assistance: The Next Health Equity Initiative for ACA & Medicare Plans

This initiative tackles financial disparities directly, ensuring that all members, especially those from low-income backgrounds, have access to affordable care without the burden of overwhelming medical debt.

How Emry’s BillAssist Erased a $77K Hospital Bill

An employee with a MEC plan and no hospital coverage faced a $77,000 bill, but Emry’s financial assistance technology secured hospital aid that covered the full amount, saving them from medical debt.