An Extra Layer of Protection Against Costly Hospital Bills

Hospital bills are among the top contributors of medical debt, often leaving individuals, particularly those with limited coverage or HDHPs, facing substantial balances.

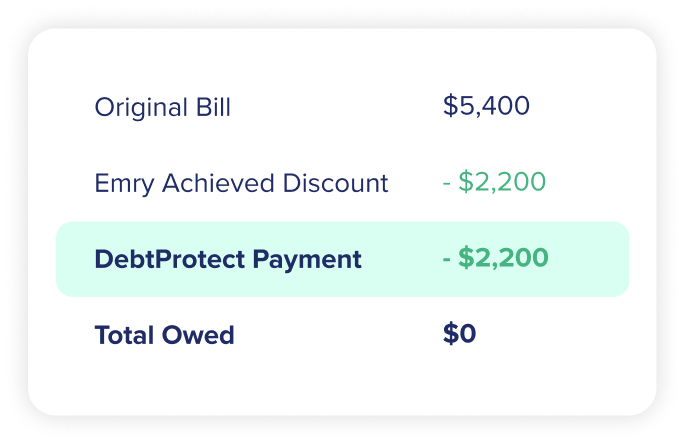

Enhanced Bill Reduction with DebtProtect

DebtProtect is an add-on program to our existing BillAssist solution. While BillAssist focuses on lowering out-of-pocket hospital and other medical bills, DebtProtect offers an extra layer of protection against remaining out-of-pocket costs.

Comprehensive Protection Against High-Cost Bills

By incorporating DebtProtect, you can further reduce or completely eliminate high-cost bills. This additional coverage ensures comprehensive financial relief, providing peace of mind and safeguarding financial well-being.

Debt Protect

How it Works

Check for Accuracy

It’s estimated that 80% of medical bills contain errors. Our experts find and fix errors that drive up out-of-pocket costs.

Reduce the Bill

If an employee doesn’t qualify for hospital financial assistance, we’ll analyze their bills—up to 80% contain costly errors, expertly negotiate lower costs and can assist with manageable payment plans.

Apply DebtProtect

DebtProtect pays employees up to a selected dollar amount, annually, for any remaining hospital bills.

*Program amount tailored to group needs.

Program Levels

Emry DebtProtect services offer program levels designed to fit any budget, ensuring comprehensive financial protection for everyone.

From inpatient stays to emergency room and outpatient surgery costs, we’ll work with you to design a custom program—and level of coverage—that fits your unique group needs.

DebtProtect seamlessly integrates with our solutions.

Navigator

Full-service healthcare guidance

HFA technology, bill review and negotiation, plus one-tap access to navigation services for lower-cost care, pharmacy discounts and human help whenever needed.

BillAssist

Lower high-cost medical bills

Our technology helps employees quickly determine eligibility for hospital financial assistance (HFA) and connects them with a navigator who can review bills for accuracy and negotiate lower out-of-pocket costs.

Industry Impact