The escalating costs of healthcare have prompted a critical examination of the resources available to mitigate expenses for both employers and employees. Hospital Financial Assistance (HFA) programs, mandated for tax-exempt nonprofit hospitals, offer free or discounted care for urgent and medically necessary services to eligible individuals. These programs are designed to help both insured and uninsured patients maintain affordable access to care. However, current hospital processes for applying are often very challenging to decipher and navigate.

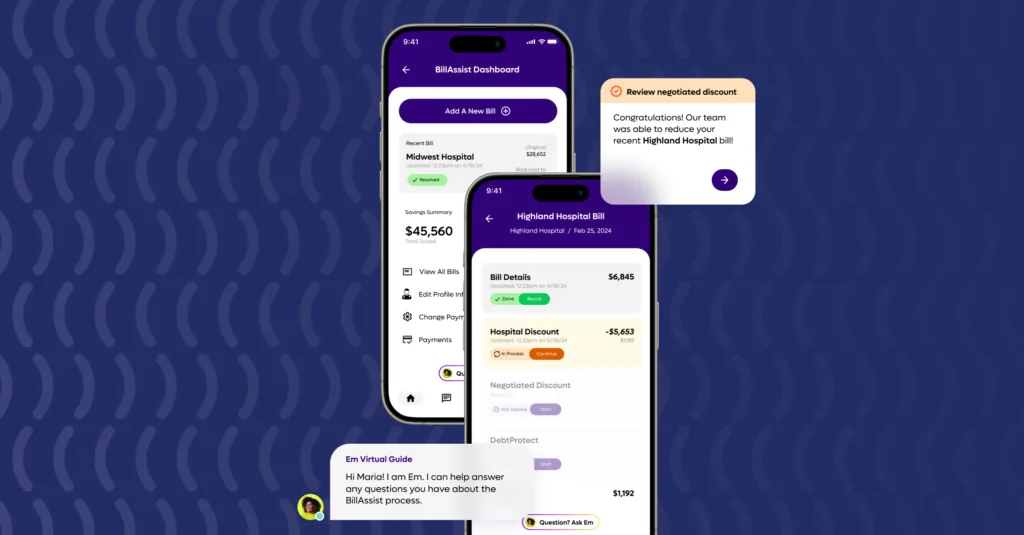

Recognizing the potential of HFA programs to alleviate financial burdens, some employers are proactively integrating hospital assistance programs into their benefits package. These solutions aim to simplify the eligibility process, making it easier for eligible employees to have their bills discounted to an amount they can afford, and often completely eliminated. This strategic approach not only supports employee well-being but also aligns with a commitment to financial health and equity within the workplace.

Keep reading to learn about the types of employers and employees who would benefit most from an integrated HFA program.

Employers Who Offer Minimum Essential Coverage (MEC) Plans

Companies offering Minimum Essential Coverage (MEC) plans typically provide basic coverage to employees, which may result in some gaps in healthcare protection. Such plans, while avoiding tax penalties under the Affordable Care Act, may offer limited protection against the full spectrum of medical expenses, especially in hospital care. Inadequate coverage can leave employees vulnerable to substantial medical bills, underscoring the need for additional support through hospital financial assistance.

Employers Offering High Deductible Health Plans (HDHPs)

High Deductible Health Plans (HDHPs) often leave employees grappling with substantial out-of-pocket expenses before their insurance benefits provide coverage. For companies offering HDHPs, incorporating hospital financial assistance into their benefits strategy can significantly alleviate the financial strain on employees, demonstrating a deep commitment to both their financial security and health.

A recent Goodroot survey underscores the financial challenge posed by HDHPs: 42% of individuals under employer-sponsored plans are required to pay deductibles ranging from $2,600 to $10,000 before their insurance contributions begin. And these figures don’t account for the monthly premiums that employees pay out of pocket. Further compounding the issue, a study by the Kaiser Family Foundation (KFF) found that a staggering 63% of Americans cannot afford a sudden $500 emergency expense.

By integrating hospital financial assistance into the benefits package, employers can provide a crucial safety net for those navigating the high upfront costs associated with HDHPs. This strategic move not only aids in managing healthcare expenses more effectively but also reinforces a culture of care and support within the organization.

Employers with Higher Concentrations of Lower-Wage Workers

Minimum wage workers often struggle with affordability issues, making healthcare expenses a significant burden. By offering access to hospital financial assistance, employers can provide a valuable resource to help these employees manage medical costs more effectively.

Small and Medium-Sized Businesses

Smaller enterprises, which may lack the resources for comprehensive healthcare coverage, can benefit greatly from incorporating hospital financial assistance into their benefits packages. This addition can offer a more supportive environment for employees without straining the company’s budget.

Startups and Growing Companies

For startups and growing companies in the early stages of developing benefits packages, including hospital financial assistance can demonstrate a strong commitment to employee health and well-being, making these businesses more attractive to current and prospective employees.

Companies in States with Limited Medicaid Expansion

In states with limited Medicaid expansion, there may be more employees without access to affordable healthcare. Employers in these regions can bridge the gap by offering hospital financial assistance.

Construction, Restaurant & Transportation Employers

Employees in these fields often face increased health risks. Integrating hospital financial assistance into benefits packages can play a crucial role in addressing these elevated healthcare needs. The 2023 Traveler’s Injury Impact Report highlights that a significant 34% of workplace injuries occur within an employee’s first year, with the construction, restaurant and transportation sectors bearing the brunt of these incidents. Notably, the construction industry is recognized by the National Institute of Health as particularly accident-prone, with a staggering 55,000 fatal injuries annually, underscoring the urgent need for enhanced employee health support in these fields.

Hospitality and Tourism Employers

Similar to the service and retail sectors, the hospitality and tourism industries often employ seasonal or part-time workers lacking comprehensive healthcare coverage. Hospital financial assistance programs provide a safety net for these employees, offering protection against unforeseen medical expenses.

Associations Serving Broad Membership

Associations with diverse memberships, including small businesses and nonprofits, have a unique opportunity to bolster their value proposition by incorporating hospital financial assistance into their offerings. This approach not only aids in delivering better benefits but could also serve as a catalyst for increased membership. For nonprofits dedicated to social causes, aligning benefits with their mission to prioritize employee well-being is paramount. Hospital financial assistance stands as a testament to their commitment, providing a safety net for employees facing health adversities.

Recent survey findings from Goodroot highlight a concerning trend: 35% of Gen Z and Millennials, alongside 37% of Gen X and older, occasionally bypass medical care due to cost concerns, risking their immediate and long-term health. This cost-avoidance behavior, prevalent across age groups, could significantly affect workplace productivity and wellness over time. By offering comprehensive and accessible health benefits, including an integrated hospital financial assistance program, employers can help their workforce avoid medical debt in an emergency—promoting a healthier, more productive workplace.

To learn more about the results of our survey and hospital financial assistance, check out our full Employer’s Guide to Financial Assistance Programs here.

The data used in this article comes from a comprehensive survey conducted by Goodroot and its affiliates to gauge medical debt prevalence among those with employer-sponsored health insurance, and the level of awareness and experiences concerning hospital financial assistance programs. This survey reached 2,000 American adults, with participants carefully chosen to reflect a diverse cross-section of the population. This selection was based on various demographic factors such as age, income, ethnicity, and insurance status, ensuring a representative and inclusive sample. For the purposes of this content, we isolated survey results to focus specifically on employees with commercial, employer-sponsored coverage.